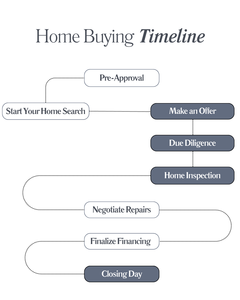

The Home Buying Timeline in North Carolina: A Step-by-Step Guide

inspection or financing conditions, to protect your interests.

Conclusion

staying organized and working closely with your real estate agent, you can navigate each step with confidence. Remember, every home-buying journey is unique, so be prepared for some flexibility along the way.